Which Word Best Describes the Closing Costs of a Mortgage

With a construction mortgage the lender will advance money based on the construction schedule of the builder. 200000 loan and you pay 2000 at 1 origination.

Click here to get an answer to your question Which word best describes the closing costs of a mortgage.

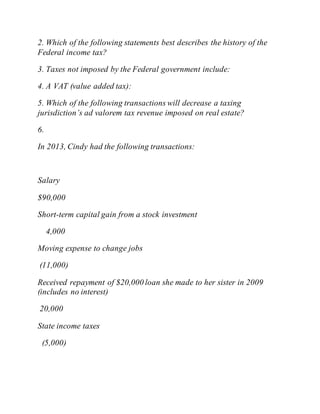

. The credits are negotiable and need to be agreed upon in writing by both the buyer and the seller. The lender requires private mortgage insurance at a rate of 075 of the loan amount. How much are closing costs.

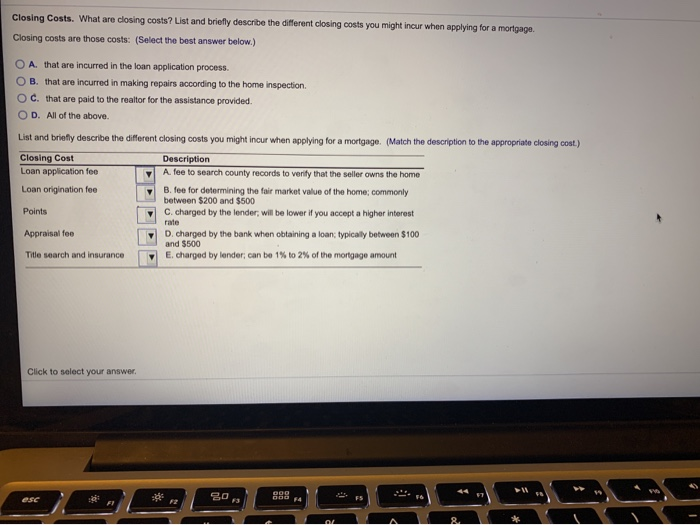

What are closing costs List and briefly describe the different closing costs you might incur when applying for a mortgage Closing costs are those costs. The greatest source of shopping center financing is. It is a cost that you pay to receive a lower interest rate on a loan.

This is probably the biggest fee youll pay to close your mortgage. June 4 2019 357 PM. A mortgage is a type of contract.

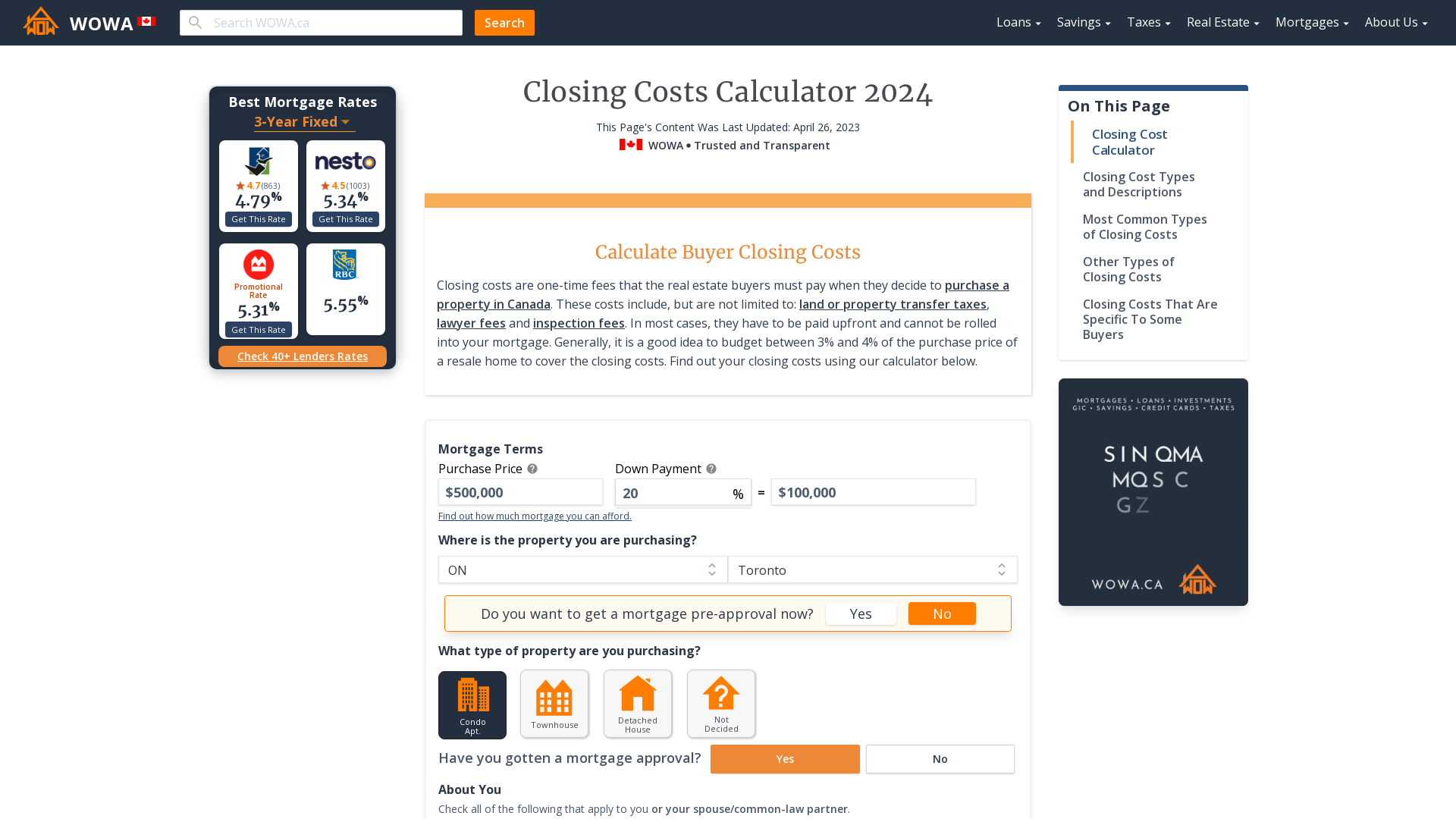

For example your various rate and fee options using a no-closing-cost mortgage might look like this. This is something that should be done before the amount is credited to. Typically home buyers will pay between about 2 to 5 percent of the purchase price of their home in closing fees.

Closing costs are the fees associated with the sale of a home that are paid at closing which may include title insurance lender fees appraisal fees and more. That are incurred in the loan application process O B. Closing costs are typically 2 to 5 percent of the propertys purchase price.

Origination fees -This is the simplest cost to understand. Its what your lender charges to prepare your mortgage loan and to review your application to make sure that you can afford it. The monthly charge for PMI is.

A mortgage closing disclosure is a federally mandated document that describes your mortgage loan in detail. Typical mortgage closing costs And what closing costs might you see on your loan. Points discount anything to get around telling you the borrower that there is a cost involved.

VA funding fee and other mortgage closing costs rolled into loan is it home acquisition debt. Closing cost credits are also known as a seller concession. So the mortgage company isnt really paying your closing costsyou are paying for it with the rate increase and unnecessary fees.

Dont be fooled by these misleading marketing tactics. It should accurately reflect all the terms of the agreement between the borrower and the lender or be corrected immediately if it doesnt. As a matter of fact my best advice is to work with a.

A point is 1 of the loan value. No they arent the same thing but lenders often use the language to describe the same costs. There are many closing costs involved ranging from attorney fees recording fees and other costs associated with the mortgage closing.

Amoney used as a down payment for the loan Bassets obtained after securing the loan Cthe purchased property that secures the loan Dclosing costs covered by the buyer 2 See answers Advertisement Advertisement olayemiolakunle65 olayemiolakunle65. At this point the buyer has to pay the fees for the services and expenses for finalizing the mortgage. Learn more about closing costs and see a list of typical closing costs here.

So if your home cost 150000 you might pay between 3000 and 7500 in closing costs. Nonrecurring D ronboii1234 ronboii1234 05012020 Mathematics Middle School answered Which word best describes the closing costs of a mortgage. Construction Mortgage - when a person is having a home-built they will typically have a construction mortgage.

When the home is. A family is purchasing their first home for 90000 with a 5 down payment. These are the Closing costs and can run between 2 to 5 of the homes market value.

To give an example if the home is valued at 400000 you can expect to pay somewhere between 8000 and 20000 in closing costs. It can range from 5 to 1 of the loan amount. Average closing costs without taxes.

Select the best answer below O A. Here are some of the most common. They will pay the annual premium in 12 equal payments added to the principal interest taxes and insurance PITI payment.

That are incurred in making repairs according to the home inspection O c. 3 rate The borrower pays all closing costs including lender fees third party fees and. It is an upfront charge to do a loan.

Many lenders will call this something else. Which phrase best describes mortgage collateral. 1098 forms for 5 different lenders over 3 years purchase 2 refis 2 loan sales and the 2019 refi has points so TT is already not being cooperative.

The percentage of the appraised value that the lender will loan the borrower to purchase a property is called. What makes it special is that its a loan secured by real estate. A mortgage note is the document that you sign at the end of your home closing.

It is deductible in the Your Home section. Are points and closing costs of a new mortgage the same thing. Im having a ton-o-fun with my 2019 home mortgage interest deduction calculations.

Average closing costs with taxes. Read this article to know more about why reading it. On average buyers pay roughly 3700 in closing fees according to a recent survey.

Solved Closing Costs What Are Closing Costs List And Chegg Com

This particular is usually apparently essential and moreover outstanding truth along with for sure fair-minded and moreover admittedly useful My business is looking to find in advance designed for this specific useful stuffs…Mortgage note buyer

ReplyDelete